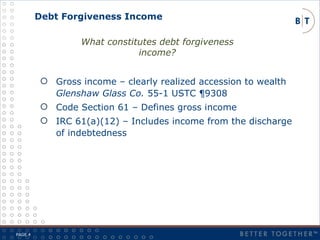

Irc 61 code#

Therefore, the LLC will need to assign its total income item by item to California, based on the rules for assigning sales under Revenue and Taxation Code (R&TC) Sections 2516, and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor. Schedule B does not have to reconcile with the LLC Income Worksheet since it includes total worldwide income, Schedule B amounts are also adjusted for differences between state and federal law, such as differences for depreciation and deductible taxes. However, if the LLC conducts business both within and outside of California, line 1a of the Schedule IW will not be the same as Form 568, Schedule B, line 3. If your LLC is a multiple member LLC that operates only in California, you will transfer the amount from Form 568, Schedule B, line 3, to line 1a of the Schedule IW. Each LLC, regardless of whether it is a multiple member LLC or a single member LLC (SMLLC) must calculate total income and pay the fee. This includes income from all sources, such as income from trade or business activities, rentals, interest, and dividends.įor more information on "total income from all sources derived from or attributable to California," see the instructions for the Schedule IW instructions, on page 14 of the 2018 Limited Liability Company Tax Booklet (Form 568). For purposes of this worksheet, “Total California Income” means total income from all sources derived from or attributable to this state, not worldwide income. The Schedule IW, Limited Liability Company Worksheet, is used to calculate an LLCs “Total California Income” to determine the amount of the LLC fee.

Schreiber, J.D., ( ) is a JofA senior editor.Schedule IW, Limited Liability Company (LLC) Income Worksheet 31, 2018, the AICPA submitted comments to Treasury and the IRS in response to Notice 2018-61 concerning a beneficiary’s ability to claim excess deductions allowed to the beneficiary upon the termination of a trust or estate under Sec. 31, 2017, and on or before the date these regulations are published as final regulations in the Federal Register in which an estate or trust terminates. 642(h) proposed regulations for beneficiaries’ tax years beginning after Dec. 31, 2017, and on or before the date the regulations are published as final regulations. 67 proposed regulations for tax years beginning after Dec. In addition, the IRS is permitting estates and nongrantor trusts and their beneficiaries to rely on the Sec. The regulations are proposed to apply to tax years beginning after they are published as final in the Federal Register. It is encouraging the public to submit comments electronically because of the current shortage of staff to process comments received by mail. The IRS is accepting comments from 45 days after May 11, the day the regulations are scheduled to be published in the Federal Register.

The preamble to the proposed regulations confirms that excess deductions are allocated to beneficiaries using the rules of Regs. 642(h) excess deduction retains its separate character as an amount allowed in arriving at adjusted gross income, as a non–miscellaneous itemized deduction, or as a miscellaneous itemized deduction. Under the proposed regulations, each deduction comprising the Sec. 642(h) excess deductions, which are passed on to beneficiaries when a trust terminates.

Irc 61 how to#

Notice 2018-61 had left unanswered the question of how to treat Sec. These rules apply to estates and nongrantor trusts (including the S portion of an electing small business trust) and their beneficiaries. The distribution deduction for estates and trusts accumulating income.The distribution deduction for trusts distributing current income to beneficiaries and.The personal exemption of an estate or nongrantor trust.Costs paid or incurred in connection with the administration of an estate or nongrantor trust that would not have been incurred if the property were not held in the estate or trust.The proposed regulations would allow estates and trusts the following deductions under Sec. The proposed regulations also explain how to determine the character, amount, and allocation of deductions in excess of gross income that a beneficiary succeeds to on the termination of an estate or nongrantor trust. 1, 2026, enacted by the law known as the Tax Cuts and Jobs Act, P.L.

According to the proposed rules, which formally adopt guidance first issued in Notice 2018-61, these deductions are not affected by the suspension of the deductibility of miscellaneous itemized deductions for individual taxpayers for tax years beginning after Dec. The IRS on Thursday issued proposed regulations ( REG-113295-18) to clarify that certain deductions are allowed to an estate or nongrantor trust because they are not miscellaneous itemized deductions.

0 kommentar(er)

0 kommentar(er)